Bank account life insurance is a term that is becoming increasingly popular among individuals seeking ways to protect themselves and their loved ones financially. It is an innovative insurance policy that combines the features of a life insurance policy and a bank account. This policy offers a unique way to create an emergency fund and cover your life insurance needs simultaneously.

The policyholder can deposit money into the account, and in case of their unfortunate death, the funds are disbursed to the designated beneficiaries to cover the expenses. In this blog post, we’ll discuss all the critical aspects of bank account life insurance, including how it works, its advantages, and how you can apply for it.

Bank Account Life Insurance

Bank account life insurance refers to a type of life insurance coverage that is tied to a particular bank account. This type of coverage is often offered by banks and financial institutions as an added benefit to account holders, and it typically provides a death benefit to the account holder’s beneficiaries in the event of their untimely death.

In this article, we will take a closer look at bank account life insurance, including how it works, its benefits and drawbacks, and whether or not it is a good option for you.

What is Bank Account Life Insurance?

Bank Account Life Insurance (BALI) is a type of life insurance product that is linked to a bank account. The policyholder sets up the policy, and the premiums are automatically deducted from their bank account monthly. It is a convenient way to ensure that your loved ones will be financially protected in the event of your death.

The coverage amount is typically small, making it an affordable option for those who may not be able to afford traditional life insurance policies. Additionally, BALI policies can be issued quickly without the need for a medical exam, making it an attractive option for those who may have health issues.

Explanation of Bank Account Life Insurance

Bank Account Life Insurance, also known as Simplified-Issue Life Insurance, is a straightforward type of life insurance that can provide financial protection to your beneficiaries. The process for obtaining a BALI policy is quick and easy, typically requiring only a few basic questions and an electronic signature. This makes it an excellent choice for people who need life insurance coverage quickly, without the hassle of medical examinations or extensive paperwork.

The policy’s duration is usually between five and twenty years, and the premiums remain the same throughout the policy term. If the policyholder passes away, the death benefit is paid directly to the beneficiary tax-free.

Overall, BALI is an affordable, accessible, and secure way to protect your loved ones should the unthinkable happen.

Benefits of Bank Account Life Insurance

One of the most significant benefits of BALI is its simplicity and ease of access. As mentioned earlier, the process for obtaining this type of life insurance is quick, and the premiums remain the same throughout the policy duration.

BALI is an affordable option for individuals who need coverage but cannot afford traditional life insurance policies, which usually require higher premiums and medical examinations.

Another benefit of BALI is its flexibility. You can adjust the policy’s duration, death benefit, and premium payments to suit your budget and financial needs.

This means you can customize your policy to provide the coverage you need while staying within your budget constraints.

Finally, BALI policies are typically free of complicated clauses and restrictions. Once you have the policy, you can rest assured that the death benefit will be paid out to your beneficiaries if you pass away within the policy duration.

This gives you and your loved ones peace of mind, knowing that you have protection in place should the worst happen.

How Bank Account Life Insurance Works

Bank Account Life Insurance (BALI) is a type of life insurance that is directly linked to your bank account. It works by deducting a fixed premium from your bank account every month to provide coverage for a specific duration. The policyholder designates their beneficiaries, who will receive the death benefit if the policyholder passes away within the policy duration.

BALI policies do not require medical exams and are typically issued quickly. Once the policy is in place, it remains the same until its expiration, unless you choose to make changes to it.

This straightforward and affordable form of life insurance has become increasingly popular among individuals seeking additional protection for their loved ones.

Who Can Benefit from Bank Account Life Insurance

Bank Account Life Insurance (BALI) can benefit individuals who are looking for a simple and hassle-free way to protect their loved ones. This type of insurance is ideal for those who may have medical conditions that make it difficult to obtain traditional life insurance.

BALI policies also provide peace of mind and financial security to those who have dependents or people who rely on them financially.

Additionally, BALI policies can serve as a final expense insurance policy, ensuring that any funeral expenses or outstanding debts are taken care of without placing a financial burden on loved ones.

Overall, Bank Account Life Insurance offers an affordable and accessible solution for those looking to safeguard their family’s financial future.

How to Set Up Bank Account Life Insurance?

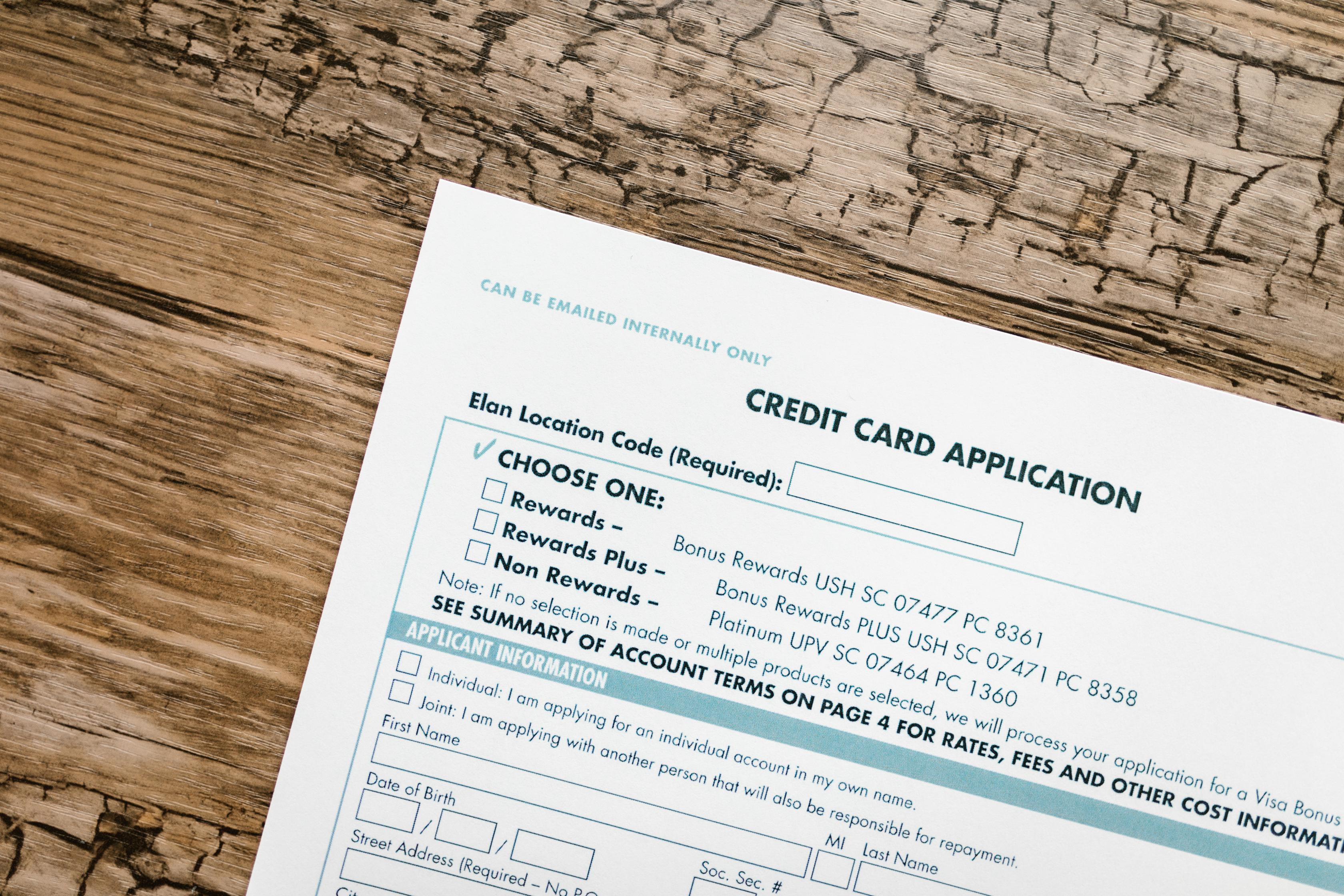

Setting up Bank Account Life Insurance (BALI) is a straightforward process. Individuals can open a savings account with a bank that offers BALI and choose the amount of coverage they want.

Some banks may require individuals to fill out a medical questionnaire, but there is typically no need for a medical exam.

The premiums for BALI are deducted automatically from the individual’s savings account on a monthly basis, making it a convenient and hassle-free way to pay for life insurance. It is important to note that the coverage amount is limited to the balance of the savings account, so it is essential to maintain sufficient funds in the account.

Overall, setting up BALI is a simple and accessible way to protect your loved ones and ensure financial security in the event of an unexpected death.

Finding a Bank that Offers Bank Account Life Insurance

Not all banks offer BALI, so it is important to research and find a bank that provides this type of coverage. Start by checking with your current bank, or you can visit the website of different banks to see if they offer BALI.

Compare the coverage amounts, premiums, and terms of different plans before choosing the one that fits your needs. It is also advisable to read the fine prints and terms and conditions of the policy to ensure that you fully understand the coverage and benefits.

Once you have selected a bank, you can open a savings account and opt for Bank Account Life Insurance.

Some banks may require you to have a minimum balance or maintain a minimum amount in the account to be eligible for BALI.

Overall, finding a bank that offers BALI is the first step in securing life insurance coverage that is convenient, affordable, and accessible.

Enrolling in Bank Account Life Insurance

Enrolling in a Bank Account Life Insurance policy is a simple process compared to traditional life insurance. After selecting a bank that offers BALI, you can opt for it while opening your savings account with that bank.

Most banks do not require any medical underwriting or complex paperwork to enroll in BALI. You can easily start the coverage by paying a nominal premium every month or annually, depending on the bank and plan chosen. BALI offers coverage for an individual or joint account in most cases, making it a favorable option for couples and families.

Moreover, the coverage amount can be increased or decreased as per the individual’s changing needs. In case of a policyholder’s demise, the nominee or legal heir can claim the coverage amount by providing necessary documents to the bank. The claim process is straightforward, and the coverage amount is paid directly to the nominee’s bank account.

To conclude, enrolling in a Bank Account Life Insurance policy is a hassle-free and affordable option for those looking for life insurance coverage without the hassles of traditional insurance. Find a bank that offers BALI and secure your family’s financial future.

Premiums and Coverage Options for Bank Account Life Insurance

Bank Account Life Insurance (BALI) is a simplified and affordable option for life insurance coverage. Most banks offer BALI at nominal premiums, making it an attractive option for many who may not be able to afford a traditional life insurance policy.

There are various coverage options available, and the premium amount depends on the plan and the bank chosen. Some banks even offer a free cover as a part of the savings account opening package. Additionally, BALI plans offer flexibility to increase or decrease coverage amounts as per changing needs.

Overall, BALI provides a hassle-free and easily accessible way of securing your and your family’s financial future.

Updating and Managing Bank Account Life Insurance

Once enrolled, it is important to keep your BALI policy up to date with accurate information, such as changes to beneficiaries or coverage amounts. Some banks allow for easy updates online or through their mobile app, making it a convenient option for busy individuals.

It is also important to regularly review your coverage to ensure it still meets your needs, especially in times of significant life changes such as marriage, childbirth, or purchasing a home.

Overall, taking the time to understand and manage your BALI policy can provide peace of mind knowing that your loved ones are financially protected in case of the unexpected.

Pros and Cons of Bank Account Life Insurance

Bank Account Life Insurance, or BALI, is an insurance policy that is tied to your bank account. It is designed to provide financial protection for your loved ones in the event of your unexpected death. But is BALI the right option for everyone?

Here are some of the pros and cons of this type of insurance policy. Pros:- Easy to enroll: Since BALI is offered through your bank, enrollment is typically a quick and easy process.

There is no lengthy application or medical exam required. – Convenient payment options: Premiums for BALI are often deducted directly from your bank account, making it easy to manage and ensure that payments are made on time.

– Affordable: Compared to other types of life insurance, BALI premiums tend to be more affordable, making it a good option for those on a budget. Cons:- Limited coverage: BALI typically offers a lower coverage amount compared to other types of life insurance policies. This may not be sufficient for those with significant financial responsibilities or debts.

– No customization: BALI policies are often standardized and do not offer customization options such as selecting riders or choosing a specific payout option. – Limited beneficiaries: BALI typically only allows for a few named beneficiaries, which may not be sufficient for those with more complex family dynamics or multiple dependents. Overall, BALI can be a good option for those looking for a simple and affordable way to provide financial protection for their loved ones.

However, it is important to carefully consider the limitations and ensure that the coverage amount and beneficiaries meet your specific needs.

Pros of Bank Account Life Insurance

Bank Account Life Insurance (BALI) is an increasingly popular type of insurance policy that offers several benefits. Firstly, unlike other types of life insurance, BALI is easy to enroll in since it is typically offered through your bank, and there is no lengthy application process or medical exam required.

Secondly, premiums for BALI are often deducted directly from your bank account, making it easy to manage and ensure that payments are made on time. Additionally, BALI premiums are generally more affordable, making it a good option for those on a budget.

Cons of Bank Account Life Insurance

Unfortunately, there are also some potential downsides to consider when it comes to BALI. For starters, BALI typically has lower coverage amounts compared to other types of life insurance policies.

This means that if you’re looking for a high level of coverage, BALI may not be the best option for you.

Another downside is that because BALI is often offered through banks, there may be limited options available in terms of providers. This can make it difficult to compare policies and find the best one for your unique needs.

Finally, some experts argue that the convenience of BALI may come at a cost – with fewer medical checks and underwriting requirements, premiums may be higher for those in higher risk categories.

Comparing Bank Account Life Insurance to Traditional Life Insurance

When it comes to life insurance, there are many options to choose from. One of the newer options, Bank Account Life Insurance (BALI), has gained popularity due to its ease of use and convenience.

However, it’s important to weigh the pros and cons of BALI before making a decision. As discussed earlier, one of the major downsides of BALI is the lower coverage amounts. While this may not be a concern for some, those with dependents or large financial obligations may need a larger policy to ensure their loved ones are taken care of in the event of their death.

In addition, traditional life insurance policies often have a wider range of providers to choose from, allowing individuals to compare policies and shop around for the best rates. This is not always the case with BALI, which may limit choices and options. Finally, traditional life insurance policies often require medical checks and underwriting, which can result in lower premiums for those in good health.

While BALI may be more convenient in terms of the application process, it may result in higher premiums for those with pre-existing conditions or higher risk factors. Ultimately, the decision between BALI and traditional life insurance will depend on individual needs and preferences.

It’s important to weigh the pros and cons and do thorough research before selecting a policy.

Considerations Before Choosing Bank Account Life Insurance

Bank account life insurance (BALI) is a type of life insurance that links to a policyholder’s bank account. While it may seem like a convenient option, there are several factors to consider before choosing BALI. Firstly, BALI typically offers lower coverage amounts compared to traditional life insurance policies.

If you have dependents or substantial financial obligations, you might need more coverage to ensure your loved ones are financially secure after your death. Another factor to consider is the limited options and choices available with BALI.

Traditional life insurance policies offer a more extensive range of providers, allowing you to compare policies and rates to find the best deal. Lastly, BALI may not be the best choice for those with pre-existing conditions or other high-risk factors.

Unlike traditional life insurance, BALI does not require a medical check or underwriting, which can result in higher premiums. Overall, before deciding to choose BALI, it’s important to weigh the pros and cons carefully. Consider your individual needs and preferences, and do thorough research to find the best life insurance policy for you and your family’s financial security.

Frequently Asked Questions about Bank Account Life Insurance

What is Bank Account Life Insurance (BALI)?

Bank Account Life Insurance (BALI) is a type of life insurance policy that is linked to a policyholder’s bank account. In the event of the policyholder’s death, the insurance provider will pay out a lump sum directly to the bank account.How is BALI different from traditional life insurance policies?

BALI typically offers lower coverage amounts compared to traditional life insurance policies.It also has limited options and choices available, and may not be the best choice for those with pre-existing conditions or other high-risk factors.

Does BALI require a medical check or underwriting?

No, BALI does not require a medical check or underwriting.However, this can result in higher premiums compared to traditional life insurance policies.

Who should consider BALI?

BALI may be a good option for those who require a small amount of coverage and prefer a simple, convenient option for their life insurance. However, those with dependents or substantial financial obligations may need more coverage and should consider traditional life insurance policies with more extensive options and choices available.

What Happens if I Close My Bank Account?

If you close your bank account linked to your BALI policy, you may need to update your information with the insurance provider to ensure that the benefits can still be paid out in the event of your death. Some providers may offer the option to transfer the policy to a new bank account, while others may require you to re-apply for coverage with updated information. It is important to review your policy agreement and contact your insurance provider if you have any questions or concerns about how closing your bank account may affect your coverage.

Can I Take Out a Loan Against My Bank Account Life Insurance?

Bank Account Life Insurance (BALI) is designed to provide a death benefit to your beneficiaries in the event of your passing. However, it is not a cash value policy, which means you cannot take out a loan against it. The policy is purely for protection and does not accumulate any cash value over time.

If you need a loan, it is advisable to consider other options such as personal loans or home equity loans.

What Are the Benefits of Bank Account Life Insurance Policies?

One of the main benefits of BALI policies is their affordability. Typically, the premiums for these policies are low compared to other life insurance policies. BALI policies also offer a simple application and approval process, making it easy for individuals who may have difficulty getting approved for other types of policies.

Additionally, the death benefit is paid out quickly and without much hassle, providing peace of mind for your loved ones in case of unexpected mishaps.

What Happens if I Change Banks?

If you have a BALI policy and change banks, the policy will not be affected. The policy is often tied to your personal information rather than your bank itself. However, it is important to keep your beneficiaries up to date if you make any changes to your account information such as a change of address.

It is also important to note that BALI policies are often only available through specific banks, so if you do change banks, you may need to explore your options for a new policy at your new bank.

Overall, Bank Account Life Insurance policies offer a simple and affordable option for individuals looking for life insurance coverage.

While they do not offer a cash value or the ability to take out a loan, they do provide peace of mind and financial protection for your loved ones in the event of your passing.

Can I Name Multiple Beneficiaries for My Bank Account Life Insurance?

When it comes to naming beneficiaries for your Bank Account Life Insurance (BALI) policy, you can typically name multiple individuals. This can include a spouse, children, or other loved ones who would financially benefit from the policy in the event of your passing.

However, it’s important to keep in mind that you should regularly review and update your list of beneficiaries to ensure that it reflects any changes in your life. For example, if you get divorced or have a child, you may need to make adjustments to your beneficiaries. Additionally, you should be aware that in the event of your passing, the beneficiaries listed on your BALI policy will receive the entire death benefit.

This means that you should carefully consider who you name as your beneficiaries to ensure that your wishes are carried out appropriately. Overall, BALI policies offer a simple and affordable way to provide financial protection for your loved ones.

By understanding how these policies work and naming your beneficiaries carefully, you can ensure that your family is taken care of in the event of your passing.

Conclusion of Bank Account Life Insurance

Bank account life insurance is a saving plan that offers life coverage for account holders. It provides protection in the event of the account holder’s death and ensures financial stability for their dependents. Bank account life insurance offers various benefits such as flexible coverage amounts, no medical exams, and no waiting periods.

It is an affordable and convenient way to secure one’s family’s future.

FAQ’s of Bank Account Life Insurance

What is the cash value of a $100life insurance policy?

It is not possible to determine the cash value of a $100 life insurance policy without additional information about the policy, such as the type of policy, the length of time it has been in force, and any applicable fees or charges.

Is bank owned life insurance a good investment?

As an AI language model, I cannot provide any personal opinions or advice. However, Bank Owned Life Insurance (BOLI) is a type of investment that can provide benefits to both the bank and the policy holder, but investors should consider all factors and risks involved before investing. It is advisable to seek the advice of a financial professional before making any investment decisions.

How long does it take to build cash value on whole life insurance?

The accumulation of cash value in whole life insurance policies typically starts after the first year of premiums have been paid, and the cash value grows slowly over time. It may take several years or even decades to build up a significant amount of cash value in a whole life insurance policy.

What is the downside of cash value life insurance?

The downside of cash value life insurance is that it tends to have higher premiums than term life insurance and may not provide as much coverage for the same cost. Additionally, a portion of the premiums paid goes towards building up the cash value, which means that the death benefit may be smaller than with term life insurance. The cash value may also be subject to fees and charges, and there could be tax implications when accessing the funds. Finally, the rate of return on the cash value may be lower than other investment options.

What is a life insurance cash account?

A life insurance cash account is a savings account that is part of a permanent life insurance policy. It allows policyholders to accumulate savings on a tax-deferred basis and withdraw money or borrow against it.

How much can you borrow from life insurance with a cash value?

The amount that you can borrow from life insurance with a cash value depends on the policy’s terms and conditions, including the cash value available and loan interest rates. Generally, policyholders can borrow up to the amount of cash value accumulated in their policy. However, it is recommended to consult with the insurance company or financial advisor to understand the specific terms and limitations of the policy.

What is a cash account in insurance?

A cash account in insurance is a type of life insurance policy that accumulates a savings component over time. The policyholder pays premiums that are split between the cost of insurance and the cash value of the policy. The cash value can be used for loans, withdrawals, or to pay future premiums.